That’s according to a new report by MarketsandMarkets. The report also includes the analysis of number of chargers for new vehicles in depot setting, number of chargers for ECV parc in depot setting, cost of chargers (including installation cost) for new vehicles in depot setting, energy demands and cost of energy.

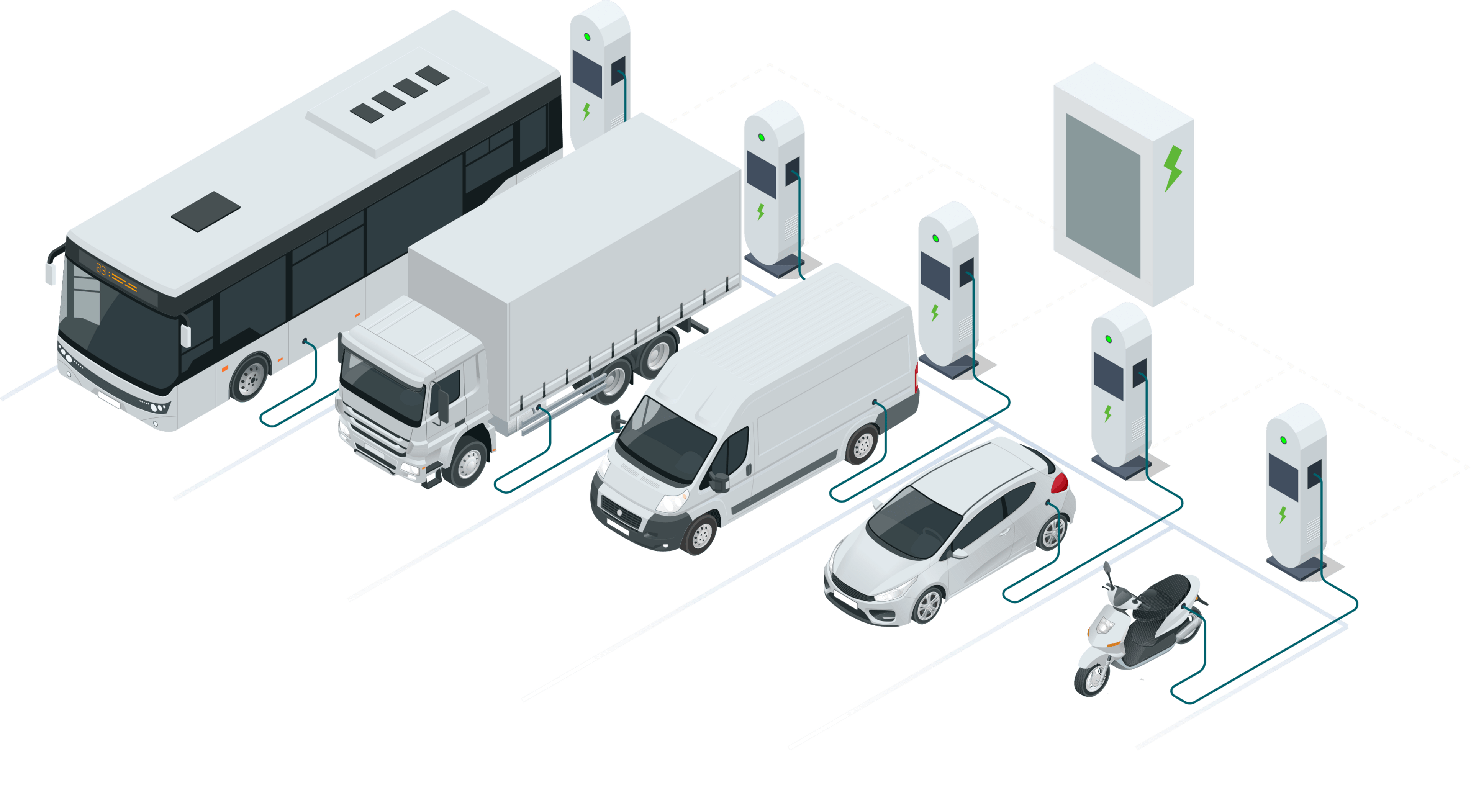

The growth of the CV depot charging market is influenced by various factors such as adoption of electric commercial vehicles, development, and manufacturing of fast and ultra-fast charging points, monetisation of depot charging business models and trends related to used cars.

Countries such as China, US, Germany, and India have increased their investments in the development of CV depot charging industry due to the growing urban population and economy in these countries. Because of such investment, demand for CV depot charging will be more during the forecast period.

The eLCV segment share contributes over 75% of the share in the ECV under the depot setting market. The eMCV and eHCV will have a significant growth and increase its share in the vehicle type segment. However, eBuses share will decline as compared to that held in 2023. Further, the combined market of eMCV and eHCV will grow by 6% from 2023 to 2030. This growth is expected owing to a rise in the adoption of depot charging infrastructure as well as its affordability over traditional ICE commercial vehicles.

Asia Pacific region holds the major share in new ECV sales, contributing over 50% in the market. The major factor for this is the intensive manufacturing and export of vehicles in China. The Chinese market is the world’s largest market in terms of vehicle sales as well as production. Moreover, the Chinese market has significantly grown post Covid halt. The recovery effect of the economy in China has led to intensifying of the manufacturing sector. One of the key trends/strategies followed by the Chinese EV makers is expansion to the European market for EV sales expansion. Moreover, countries such as India, Singapore and South Korea significantly contribute to the growth of the ECV sector in the Asian region. In addition, depot charging trends are rapidly developing in the Indian market with adoption of different types of business models.

The report, Future of CV Depot Charging Market, cites the major players as ABB (Switzerland), Blink (US), Bosch (Germany), BP Pulse (UK), ChargePoint (US), EVgo (US), Heliox (Netherlands), Kempower (Finland), Shell Recharge (US), Siemens (Germany), and Wallbox (Spain).

Follow Us On Social Media